Many B2B companies are sacrificing long-term growth at the expense of immediate results, without realizing it.

Leadership expects results this quarter.

Sales need to fill the pipeline now.

The budget gets carved up into performance campaigns that convert the 5% of buyers actively in-market.

Rinse, repeat.

Growth plateaus. The pressure intensifies, and this cycle goes on.

Meanwhile, research shows that long-term brand campaigns are 3 times more likely to drive large business effects such as market-share growth and 60% more likely to improve profit. But when you’re being evaluated on this quarter’s MQLs, playing the long game feels out of reach, right?

On November 19th, 60+ B2B marketers gathered to hear Richard Parsons, co-founder of True and the only B2B agency to receive the IPA Effectiveness Accreditation, make the case for a different approach. Not long-term instead of short-term, but a strategic balance between both that actually accelerates growth.

Here’s what the people in the room learned about the five principles of growth in B2B that separate companies playing checkers from those playing chess.

Principle 1: Invest in share of voice (because it predicts market share)

Richard opened with a chart that makes most CFOs uncomfortable: increasing your share of voice drives market share growth. A 10% extra share of voice causes market share to rise by 0.7% per annum for B2B brands. For service brands, this jumps to 1.8%.

Brands can actually buy their way into growth by spending and increasing their share of voice above their current market share. Share of voice is actually the leading indicator of growth, not just a vanity metric.

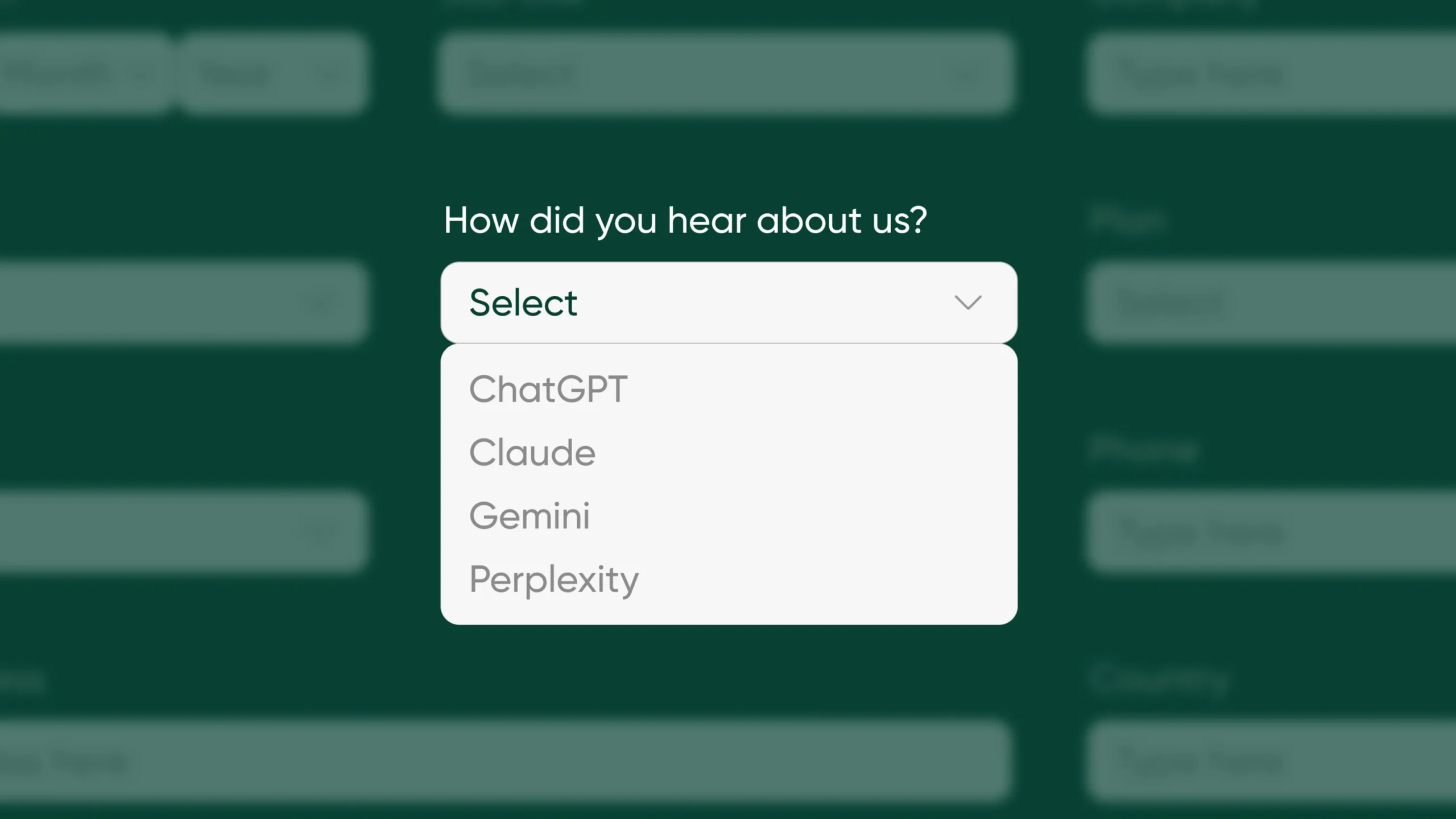

When your brand shows up consistently in the spaces where your buyers live, you’re building mental availability. You’re making it easier for someone to think of you when they encounter the problem you could solve. This includes everything from search results, industry publications, LinkedIn feeds, conferences, and LLM outputs.

The math is simple: if you want to grow faster than your competitors, you need to be more visible.

Most B2B companies underspend, hoping to use their budgets as efficiently as possible.

Principle 2: Fame is your number one objective

Here’s the uncomfortable truth Richard shared: the three brands that come to mind first win 90% of B2B sales, despite the fact that buyers later add 10+ competitors to their research list.

Think about how you buy software.

Something breaks, or a specific need emerges.

Your brain immediately surfaces 2-3 brands you’ve heard of.

You might add 7-10 more during research, but the winner almost always comes from those first three. Because people look for familiarity and the comfort that comes from buying a brand you know. In most cases, buying from unknown brands is risky.

This is why fame matters more than awareness.

Awareness means they’ve heard of you.

Fame means you’re the default choice, or at least in the top 3 solutions that quickly come to mind in a specific category.

Building fame requires being consistently present, distinctive, and memorable. Not just “visible.”

The Acora case study Richard shared illustrated this perfectly.

Acora is an IT management company competing in a category full of faceless competitors focused on service-level agreements (SLAs). They challenged the status quo with their Experience Level Agreements (XLAs) and built a brand platform around revolution: “Long Live the XLA.”

The campaign featured an emotional, visually striking creative: a CEO on horseback leading an IT revolution. The data shows that the campaign brought increase in incremental revenue.

Principle 3: Expand your customer base (don’t just harvest it)

The room went quiet when Richard put up the slide showing the 95/5 rule.

At any given time, only 5% of your potential buyers are in-market. The other 95% will enter the market any time over the next few years.

Most B2B marketing focuses exclusively on the 5%.

Performance campaigns, bottom-funnel content, demo requests, free trials, everything is designed to convert people actively shopping right now.

The problem with this approach is that you’re competing with every other vendor for the same tiny pool of in-market buyers.

Meanwhile, the 95% who aren’t buying yet represent your entire future revenue.

They’re the ones who will be in-market in the next five years. If you’re not talking to them now, it’s very likely you won’t be on their shortlist when they’re ready to buy.

Research shows that reach strategies deliver 1.6x the business impact of acquisition strategies, which deliver 1.0x. Loyalty strategies? 0.0x.

This doesn’t mean abandoning activation.

It means rebalance.

Stop spending 90% of your budget on harvesting demand and start creating it instead.

Principle 4: Harness the power of emotional priming

Here’s where Richard challenged the room’s assumptions about B2B being “rational.”

Emotional brand campaigns in B2B generate 1.4x business effects compared to 0.2x for rational campaigns. Over a six-month period, emotion beats logic by 7x.

This makes sense when you understand how buyers actually make decisions. The brain has two systems:

- System 1 (Limbic System): Fast, intuitive, emotional. Builds brand fame through feelings like trust, fear, and aspiration. Drives the initial choice.

- System 2 (Neocortex): Slow, analytical, logical. Provides justification using ROI data, technical specs, and competitive comparisons.

System 1 decides. System 2 justifies.

Most B2B marketing speaks exclusively to System 2.

Whitepapers. Case studies. ROI calculators. Comparison charts.

All necessary, but they’re not what gets you on the shortlist in the first place.

The data is stark: 76% of B2B ads score a “1” on System1‘s creative effectiveness scale (calculated by measuring the emotional response to the ad), meaning the creative contributes zero to market share growth.

Creative quality is a multiplier on your media spend. A 5-star ad is predicted to add an additional 3% of market share gain for every 10% of SOV.

Richard showed how a 5-star ad in a category with €500M TAM (Total Addressable Market) and 10% excess share of voice would generate €18.5M in revenue return versus €3.5M for a 1-star ad.

That’s a €15M difference with the same media budget.

Principle 5: Balance brand and lead gen (46/54, not 10/90)

According to Richard, the ideal budget split for sustained growth is 46% brand building and 54% lead generation.

Most B2B companies do the opposite: 10% brand, 90% lead gen.

Here’s what you get when you rebalance:

Brand building delivers:

- Short-term sales

- Long-term sales

- Decreases price sensitivity

- Category optionality

- Talent acquisition advantage

- Competitive moat

Activation delivers:

- Short-term sales

That’s it. Activation converts demand that already exists. The brand creates demand that didn’t exist before.

The framework Richard shared helps clarify what belongs where:

Brand building (out-of-market buyers):

- Broader targeting

- Emotional messaging

- Use memory metrics (recall, consideration)

- Content that entertains and enlightens

Activation (in-market buyers):

- Narrower targeting

- Rational messaging

- Use sales metrics (pipeline, revenue)

- Content that educates and converts

Think of it as a dual-brain funnel:

What to do next

The goal isn’t to choose between emotional and rational. It’s to use both of them strategically based on where the buyer is in their journey.

If you walked out of BISM HQ on November 19th (or you’re reading this wishing you’d been there), here’s where to start:

- Audit your current spend: What percentage goes to brand building versus activation? If it’s heavily skewed toward activation, you’re leaving growth on the table.

- Calculate your share of voice: How visible are you compared to competitors in the channels that matter? Search, social, industry media, events, analyst reports. If you’re being outspent and out-shown, you’re being out-grown.

You can use the share of search metric as a proxy for share of voice.

- Test emotional creatives: Take one campaign and make it about how your brand makes people feel, not just what it does. Measure the difference in engagement, recall, and pipeline velocity.

- Map your dual-brain funnel: What content do you have that entertains and inspires (System 1)? What educates and converts (System 2)? Most B2B companies have too much System 2 content and almost nothing for System 1.

- Build the business case: Use the frameworks Richard talked about – share of voice, the 95/5 rule, the brand vs. activation split to show leadership what you’re leaving on the table by optimizing only for this quarter.

The companies that grow predictably aren’t the ones chasing every in-market buyer.

They’re the ones that show up consistently for years, build fame, and become the default choice before the buying process even starts.

Fame and brand recognition don’t happen overnight.

You have to build them.

And you can’t build long-term if you’re only thinking one quarter at a time.

Need a second opinion on your strategy?

We know it’s hard to justify long-term investment when you’re asked for immediate results. If you want a second opinion on your strategy or you’re thinking about how to apply these principles, let’s talk. We have international experience working with high-growth companies and we’d be happy to share what we’ve learned.